| |

|

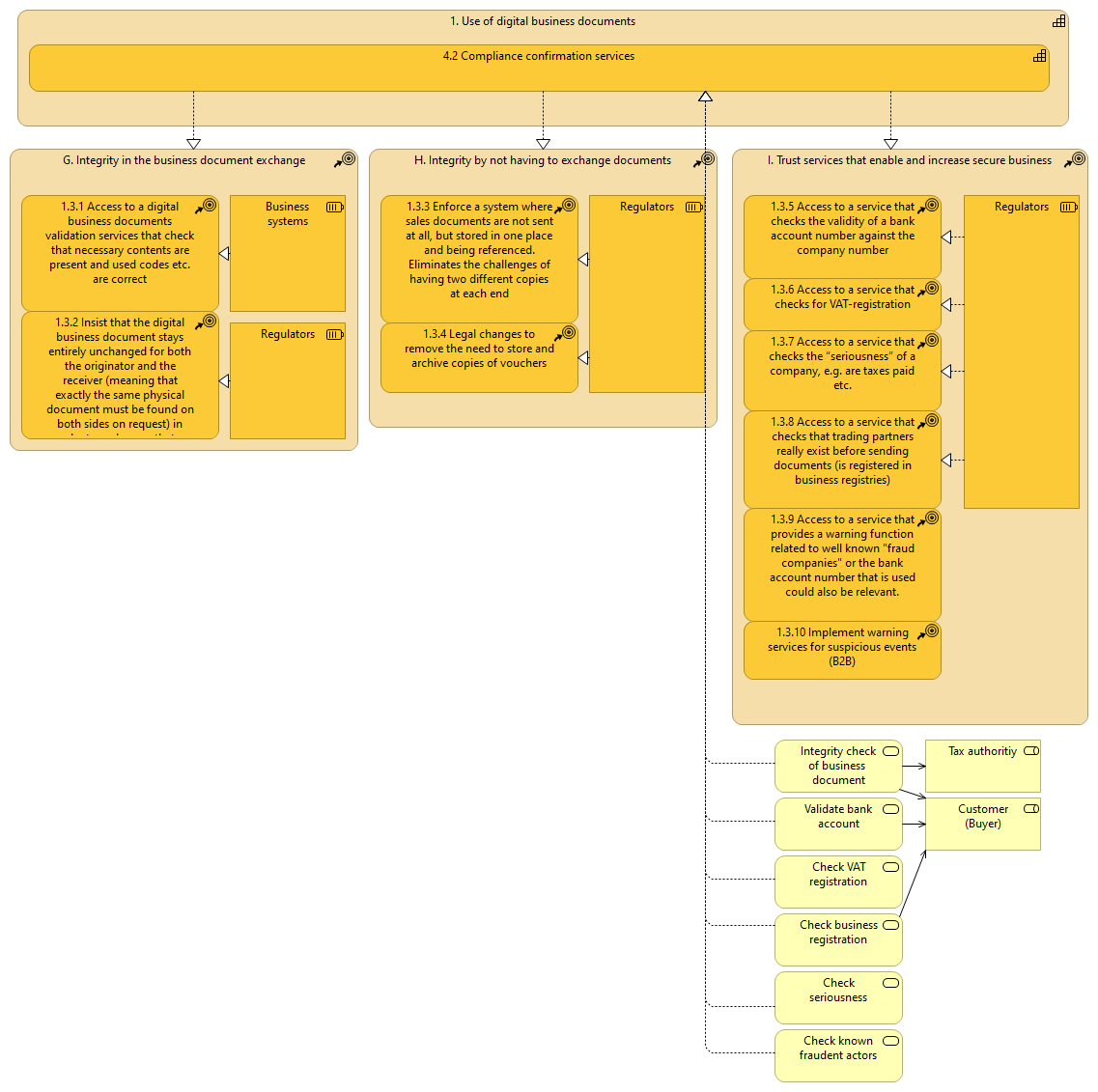

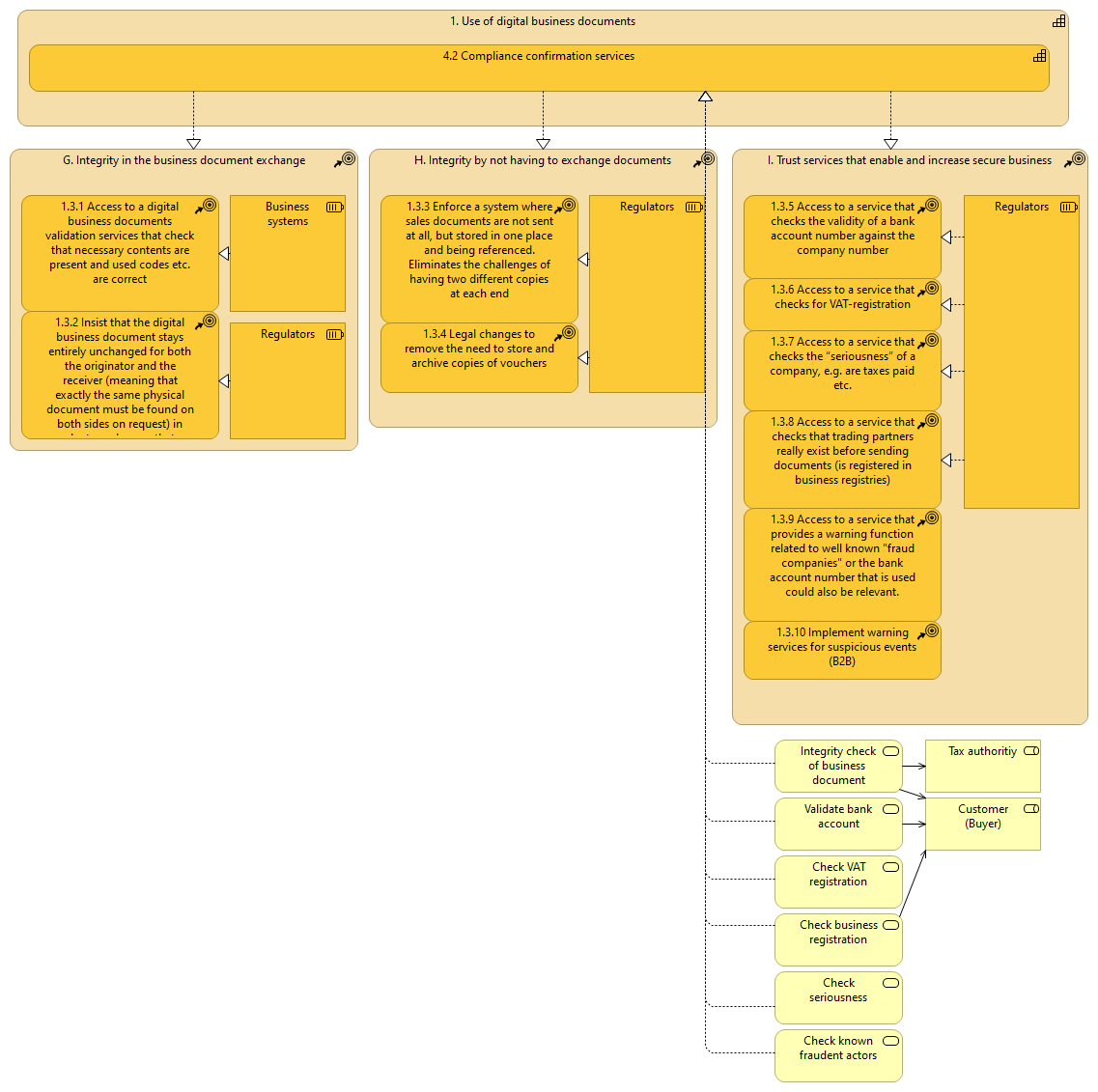

G. Integrity in the business document exchange |

1.3.1 Access to a digital business documents validation services that check that necessary contents are present and used codes etc. are correct |

| |

|

G. Integrity in the business document exchange |

1.3.2 Insist that the digital business document stays entirely unchanged for both the originator and the receiver (meaning that exactly the same physical document must be found on both sides on request) in order to make sure that a voucher is only used once. This enables automated checks (based on hash calculations) |

| |

|

Business systems |

1.3.1 Access to a digital business documents validation services that check that necessary contents are present and used codes etc. are correct |

| |

|

Business systems |

G. Integrity in the business document exchange |

| |

|

Regulators |

1.3.2 Insist that the digital business document stays entirely unchanged for both the originator and the receiver (meaning that exactly the same physical document must be found on both sides on request) in order to make sure that a voucher is only used once. This enables automated checks (based on hash calculations) |

| |

|

Regulators |

G. Integrity in the business document exchange |

| |

|

H. Integrity by not having to exchange documents |

1.3.3 Enforce a system where sales documents are not sent at all, but stored in one place and being referenced. Eliminates the challenges of having two different copies at each end |

| |

|

H. Integrity by not having to exchange documents |

1.3.4 Legal changes to remove the need to store and archive copies of vouchers |

| |

|

Regulators |

1.3.3 Enforce a system where sales documents are not sent at all, but stored in one place and being referenced. Eliminates the challenges of having two different copies at each end |

| |

|

Regulators |

H. Integrity by not having to exchange documents |

| |

|

Regulators |

1.3.4 Legal changes to remove the need to store and archive copies of vouchers |

| |

|

I. Trust services that enable and increase secure business |

1.3.5 Access to a service that checks the validity of a bank account number against the company number |

| |

|

I. Trust services that enable and increase secure business |

1.3.8 Access to a service that checks that trading partners really exist before sending documents (is registered in business registries) |

| |

|

I. Trust services that enable and increase secure business |

1.3.9 Access to a service that provides a warning function related to well known "fraud companies" or the bank account number that is used could also be relevant. |

| |

|

I. Trust services that enable and increase secure business |

1.3.10 Implement warning services for suspicious events (B2B) |

| |

|

I. Trust services that enable and increase secure business |

1.3.6 Access to a service that checks for VAT-registration |

| |

|

I. Trust services that enable and increase secure business |

1.3.7 Access to a service that checks the “seriousness” of a company, e.g. are taxes paid etc. |

| |

|

Regulators |

I. Trust services that enable and increase secure business |

| |

|

Regulators |

1.3.5 Access to a service that checks the validity of a bank account number against the company number |

| |

|

Regulators |

1.3.6 Access to a service that checks for VAT-registration |

| |

|

Regulators |

1.3.7 Access to a service that checks the “seriousness” of a company, e.g. are taxes paid etc. |

| |

|

Regulators |

1.3.8 Access to a service that checks that trading partners really exist before sending documents (is registered in business registries) |

| |

|

4.2 Compliance confirmation services |

G. Integrity in the business document exchange |

| |

|

4.2 Compliance confirmation services |

H. Integrity by not having to exchange documents |

| |

|

4.2 Compliance confirmation services |

I. Trust services that enable and increase secure business |

| |

|

Check seriousness |

4.2 Compliance confirmation services |

| |

|

Check business registration |

4.2 Compliance confirmation services |

| |

|

Check business registration |

Customer (Buyer) |

| |

|

Check VAT registration |

4.2 Compliance confirmation services |

| |

|

Validate bank account |

4.2 Compliance confirmation services |

| |

|

Validate bank account |

Customer (Buyer) |

| |

|

Integrity check of business document |

4.2 Compliance confirmation services |

| |

|

Integrity check of business document |

Tax authoritiy |

| |

|

Integrity check of business document |

Customer (Buyer) |

| |

|

Check known fraudent actors |

4.2 Compliance confirmation services |